tBTC has always been designed with a clear objective: bring Bitcoin onchain in a way that prioritizes security, transparency, and reliable market behavior. Over time, usage has grown steadily, onchain performance has remained consistent, and tBTC has continued to function as intended across a wide range of market conditions.

This update builds on that foundation.

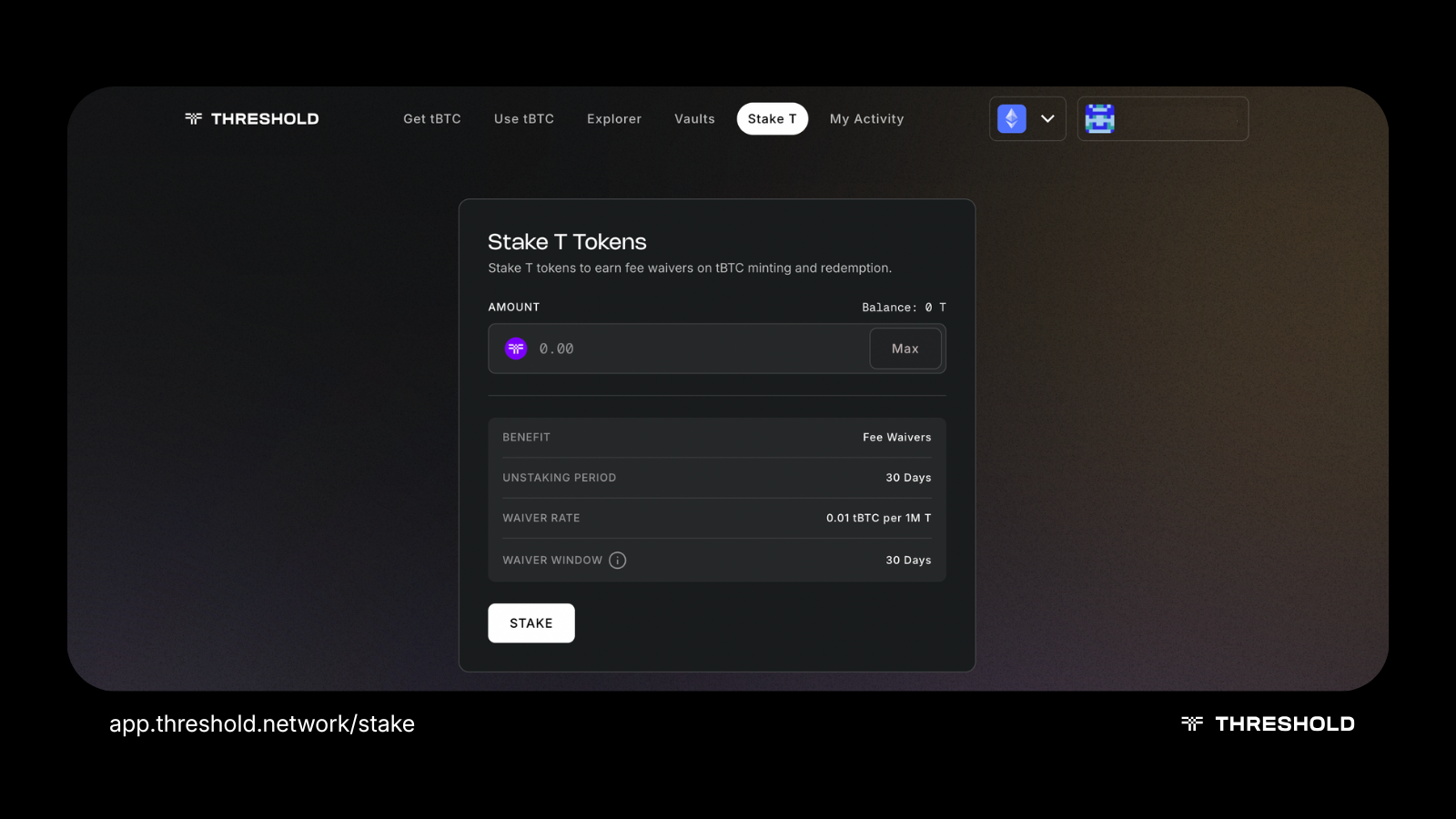

Fee waivers for $T stakers are now live on Threshold Network, introducing a new way for active participants to reduce execution costs while reinforcing the economic alignment between protocol usage and governance.

This change does not alter how tBTC works. Instead, it refines the economics around how participants interact with the bridge, particularly at scale.

Improving Capital Efficiency Without Workflow Changes

Minting BTC into tBTC remains free, in line with existing governance decisions. Redemption, which is at a 20-basis-point fee to support decentralized bridge operations, can now be partially or fully offset by staking $T.

For participants, this means:

- Lower effective execution costs over time

- Improved arbitrage efficiency between BTC and tBTC

- Tighter pricing and more reliable liquidity

- No changes to custody, settlement, or operational workflows

The mechanism is opt-in and parameterized, allowing participants to plan around fee exposure with greater precision.

Predictable Parameters, Sustainable tBTC-BTC Spread

tBTC is designed to track Bitcoin as closely as possible. Reducing redemption friction improves arbitrage efficiency, which in turn supports a tighter BTC–tBTC spread and more stable secondary markets.

Early data indicate the mechanism is functioning as intended, reinforcing pricing reliability while maintaining the protocol’s conservative security assumptions.

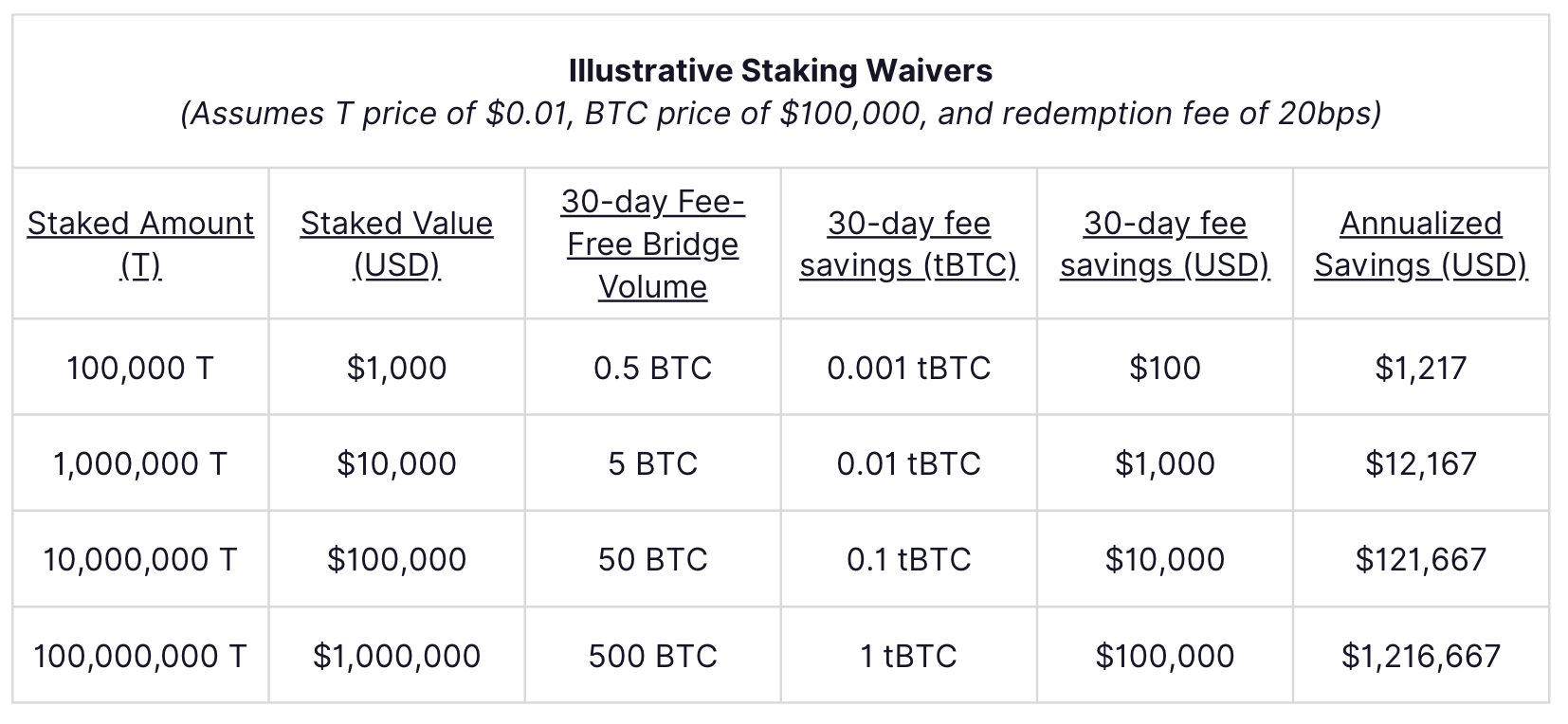

The fee waiver system is intentionally straightforward:

- Waiver capacity applies over a rolling 30-day window

- Every 100,000 $T staked offsets up to 0.001 tBTC in eligible fees

- Minting remains free; redemption fees are offset via waivers

- Unstaking requires a 30-day period

- Governance participation is unaffected

This structure favors sustained participation and minimizes short-term distortions. It’s particularly relevant for frequent bridgers, market makers, arbitrageurs, and long-term $T holders, as well as institutions looking for a more capital-efficient way to move Bitcoin onchain. Even users who don’t stake may see benefits through tighter pricing, improved liquidity, and more reliable tBTC markets overall.

Staking $T is optional. Eligible participants may access available fee waivers in accordance with applicable protocol parameters. $T token is available on most decentralized exchanges and major CEX's.

See where you can find $T at https://coingecko.com/en/coins/threshold-network-token

To start staking your $T tokens, visit https://app.threshold.network/stake

Disclaimer: This blog post is provided for informational purposes only and does not constitute financial, investment, legal, or tax advice. Nothing contained herein should be construed as an offer, solicitation, or recommendation to acquire, dispose of, or stake any digital asset.