A few weeks ago, Threshold launched the tBTC Bitcoin Vault on Starknet, introducing a new way for Bitcoin holders to access yield while preserving BTC exposure. Today, in collaboration with Noon Capital, Threshold is expanding that offering with a new Bitcoin vault on Ethereum - tBTC’s largest and most established market.

This latest vault enables users to deposit tBTC, Ethereum’s most decentralized and trust-minimized Bitcoin asset, into a professionally managed strategy powered by Noon.

Bitcoin yield via tBTC is powered by Noon’s sUSN engine, with full transparency provided through Accountable’s Data Verification Network. Together, this framework delivers performance, oversight, and verifiable execution within a streamlined onchain vault experience.

Unlocking More Utility for Bitcoin on Ethereum

Bitcoin has long been recognized as a foundational asset, but historically, it has had limited access to onchain financial infrastructure. The launch of the tBTC–Noon Vault expands what BTC can do on Ethereum, without requiring users to exit their BTC position.

By using tBTC, users can access Ethereum-native strategies through a single vault experience, while maintaining exposure to Bitcoin.

This is made possible through Threshold cryptography, which underpins tBTC and enables a more secure, resilient approach to bridging BTC into Ethereum.

How the tBTC–Noon Vault Works

The strategy begins with users depositing tBTC into the vault on Ethereum.

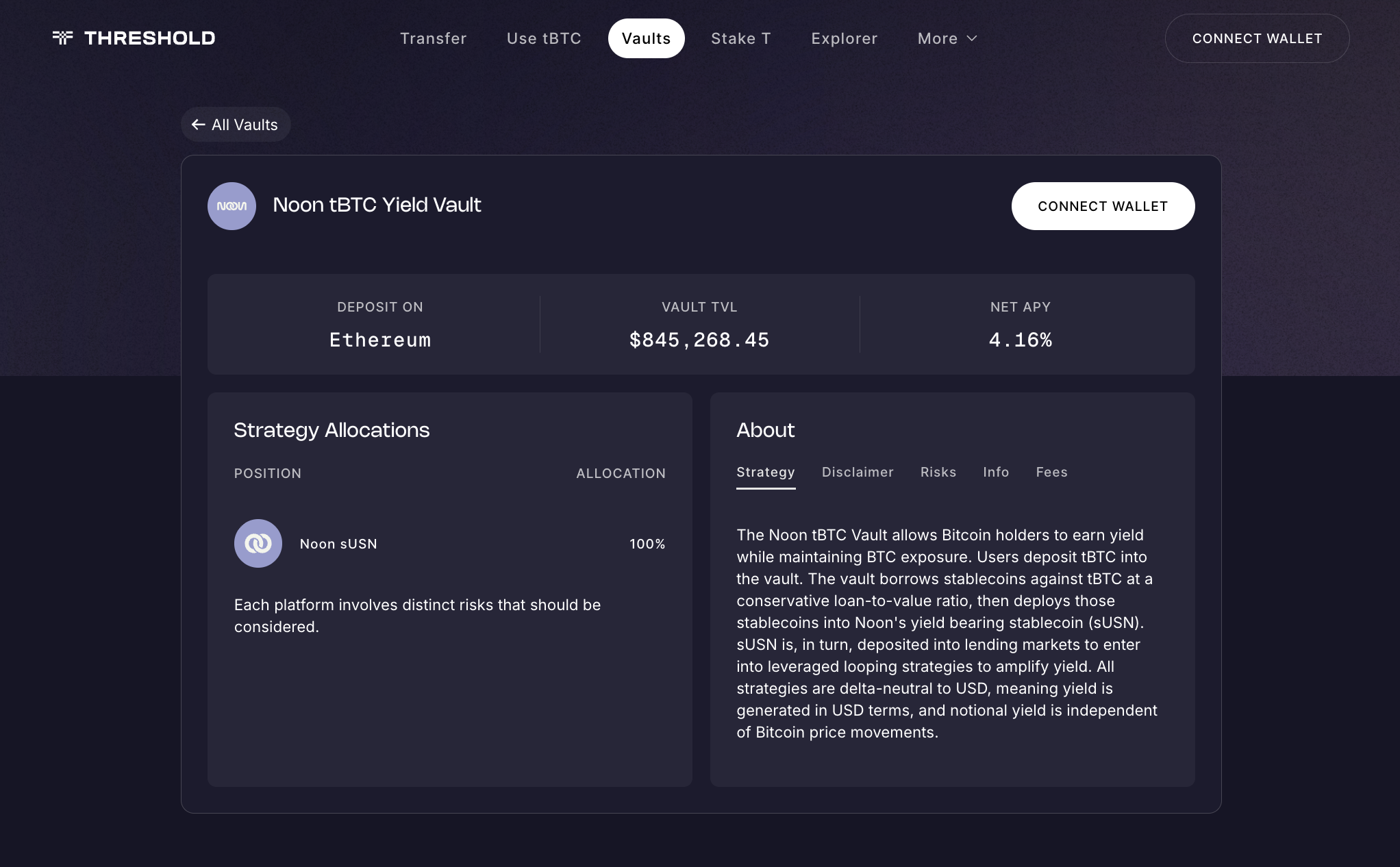

From there, the vault borrows stablecoins against the deposited tBTC at conservative loan-to-value ratios. These stablecoins are deployed into Noon’s yield-bearing stablecoin, sUSN, which is then allocated into lending markets and looping strategies designed to generate sustainable returns.

The strategy is structured so that performance is generated in USD, while the vault maintains its BTC collateral base via tBTC. At launch, the vault is fully allocated to Noon sUSN and currently displays a net APY of approximately 4.16%, with TVL over $850,000.

Deepening tBTC Integration in DeFi

The tBTC–Noon Vault represents another step forward for the Threshold ecosystem and for Bitcoin’s role in DeFi.

It demonstrates how threshold cryptography can unlock more trust-minimized access to Ethereum’s financial markets, while keeping Bitcoin at the center of the user experience. For BTC holders, this means the ability to deploy capital more efficiently without giving up exposure to the asset they believe in.

Mint or swap into tBTC via the Threshold App and allocate your position to the latest Bitcoin yield vault to access structured onchain strategies.

Disclosure: Participation in Noon vaults carries market, smart contract, and counterparty risks, as well as the potential loss of capital. Target outcomes and projected metrics are not guaranteed; actual results may vary with market conditions. This material is for informational purposes only and does not constitute investment advice, an offer, or a solicitation for capital loss.